Reducing CO2 Without the Paris Climate Agreement

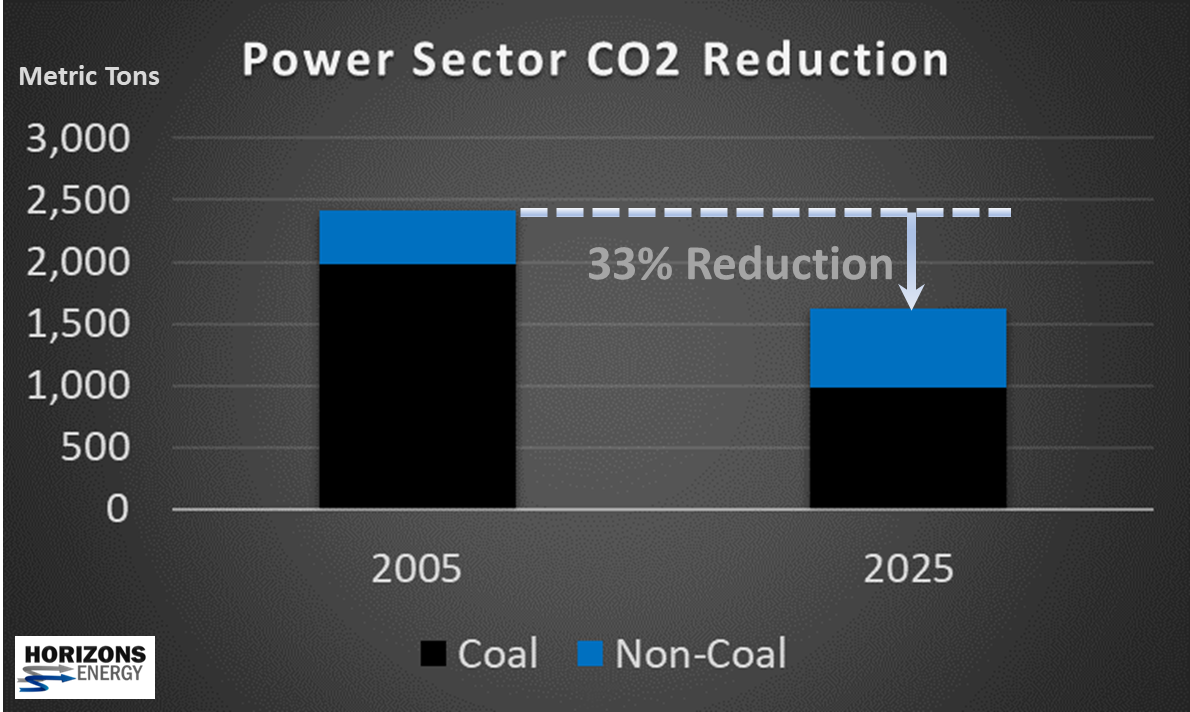

CO2 Emissions Down 1/3 by the Year 2025

The United States power sector is poised to reach or exceed the CO2 percent reductions pledged last year by the Obama administration under the Paris Climate Agreement. Meeting these reductions, 26%-28% below 2005 levels by the year 2025, will not require new CO2 legislation such as the CPP or additional incentives for renewable resources. Instead, fundamental economics appear sufficient to drive CO2 to lower levels in the coming decade.

Horizons Energy reached this conclusion after projecting current trends in North American energy markets to 2036. Key assumptions in this analysis include: only modest increases in both natural gas prices and electricity demand, meeting current state-level RPS requirements, and the likely future costs of both conventional and renewable technologies. In this case, there was no explicit attempt to incorporate any direct costs or constraints associated with emitting CO2.

To study the impacts of these factors, Horizons Energy utilized the EnCompass power planning tool and the National Database. This database contains over 16,000 generating resources with projections of power, fuel and emissions markets. Based upon inputs, the model captures market dynamics such as build/retire decisions as well as power operations and wholesale electricity prices (energy, capacity, A/S, RECs, emissions). By tracking the generation of each resource, EnCompass is also able to calculate the aggregate CO2 emission levels for the entire North American power system.

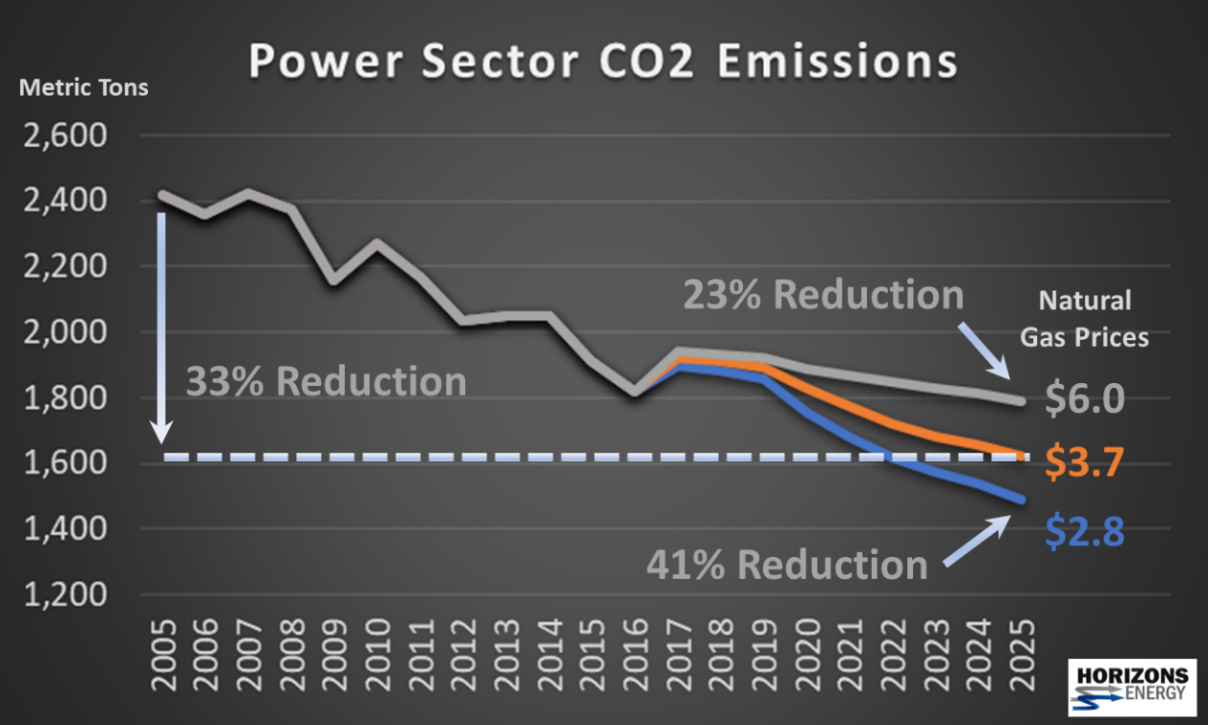

The results of this study show a 33% reduction in CO2 emissions by 2025. Recall that the EPA Clean Power

Plan (CPP) called for a 32% reduction by 2030. Remarkably, the CPP target is achieved 5 years early and without the administrative burden of the CPP. The CO2 reduction is driven by inter-fuel economics and the state-level RPS targets already in place. Simply stated, cheap natural gas and the retirement of an aging coal fleet produces a significant reduction in CO2 emissions over this time period.

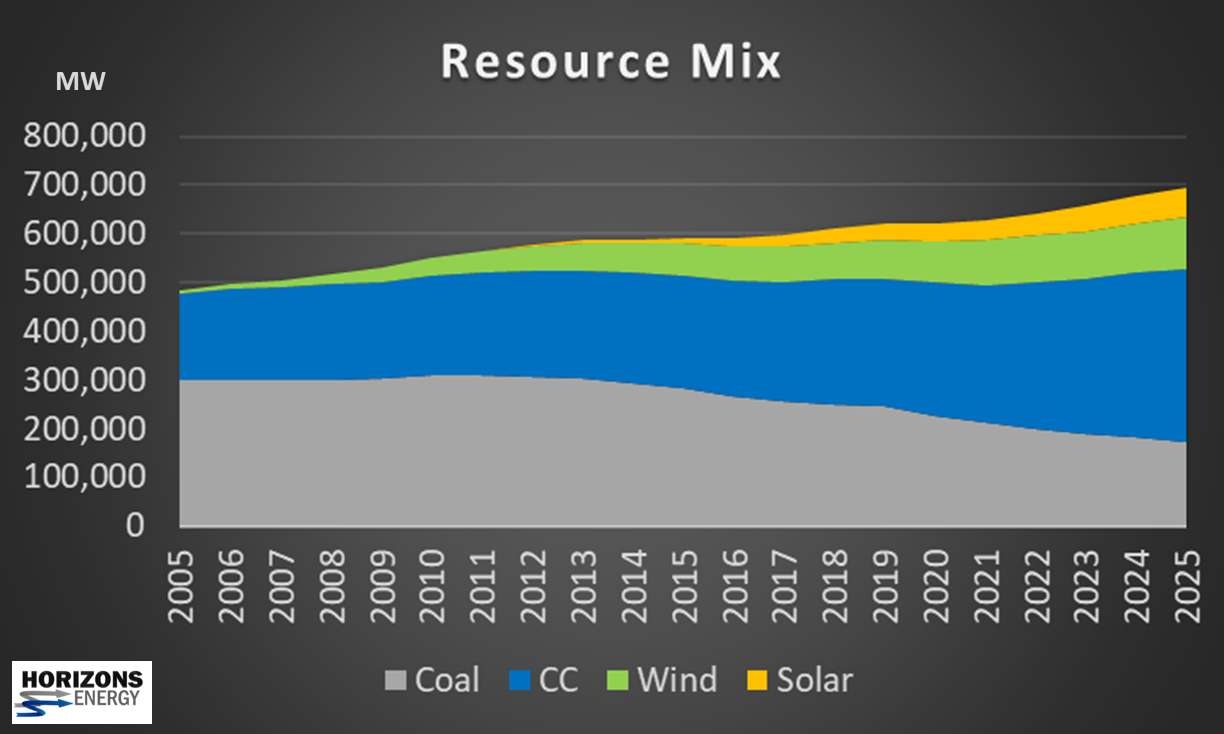

Resource Mix

As illustrated in the resource mix graph, which is focused on coal, CC, wind and solar; the retirement of the coal fleet is steady but gradual. While there is tremendous economic pressure on coal to retire; adding 116 GW of combined cycle units and 80 GW of renewable energy from 2017 – 2025 is no small task. Consequently, Horizons Energy’s coal retirement estimate of 92 GW from 2017 – 2025 balances the economic pressure on coal with the physical and financial constraints of building new CC and renewable units.

Natural Gas Price Sensitivity

Horizons Energy also considered natural gas price uncertainty by analyzing natural gas prices at $2.80/MMBtu and $6.00/MMBtu, in addition to the reference price of $3.70/MMBtu. As illustrated in the graph, the CO2 reduction varies between 41% and 23% in those scenarios.

Uncertainties to Consider

There are a wide range of factors which can affect the trajectory of Power Sector CO2 emissions. For example, it is possible the downward trend could be slowed or even reversed if there is a sudden rush of nuclear retirements. As with large coal plants, the economic pressure on nuclear plants continues to mount. Some states have already provided revenue relief in the form of zero emission credits (ZECs), while other states have rejected ZECs. Horizons Energy continues to monitor the profitability of the nuclear fleet to identify the at-risk units and the overall impact on wholesale market prices and CO2 emissions.

Conclusion

This study focused on trends driving output of CO2 in the U.S. power sector. To reach a national reduction target across all sectors will require the other sectors to either meet their respective greenhouse gas (GHG) emission reductions or rely on over compliance in the power sector. In the case of power, current economic momentum under a fairly range of outcomes appears to be sufficient to meet or exceed the targeted 26% to 28% CO2 emissions reduction.

About Horizons Energy.

Working with a variety of participants in North American electricity markets, Horizons Energy provides in-depth advisory services and Software as a Service (SaaS) solutions.

To learn more, please visit our website at https://horizons-energy.com